Renters Insurance in and around Charlottesville

Get renters insurance in Charlottesville

Your belongings say p-lease and thank you to renters insurance

Would you like to create a personalized renters quote?

Home Is Where Your Heart Is

It's not just the structure that makes the home, it's also what's inside. So, even if your home is a rented townhouse or space, renters insurance can be the most sensible step to protect your valuables, including your smartphone, coffee maker, laptop, sports equipment, and more.

Get renters insurance in Charlottesville

Your belongings say p-lease and thank you to renters insurance

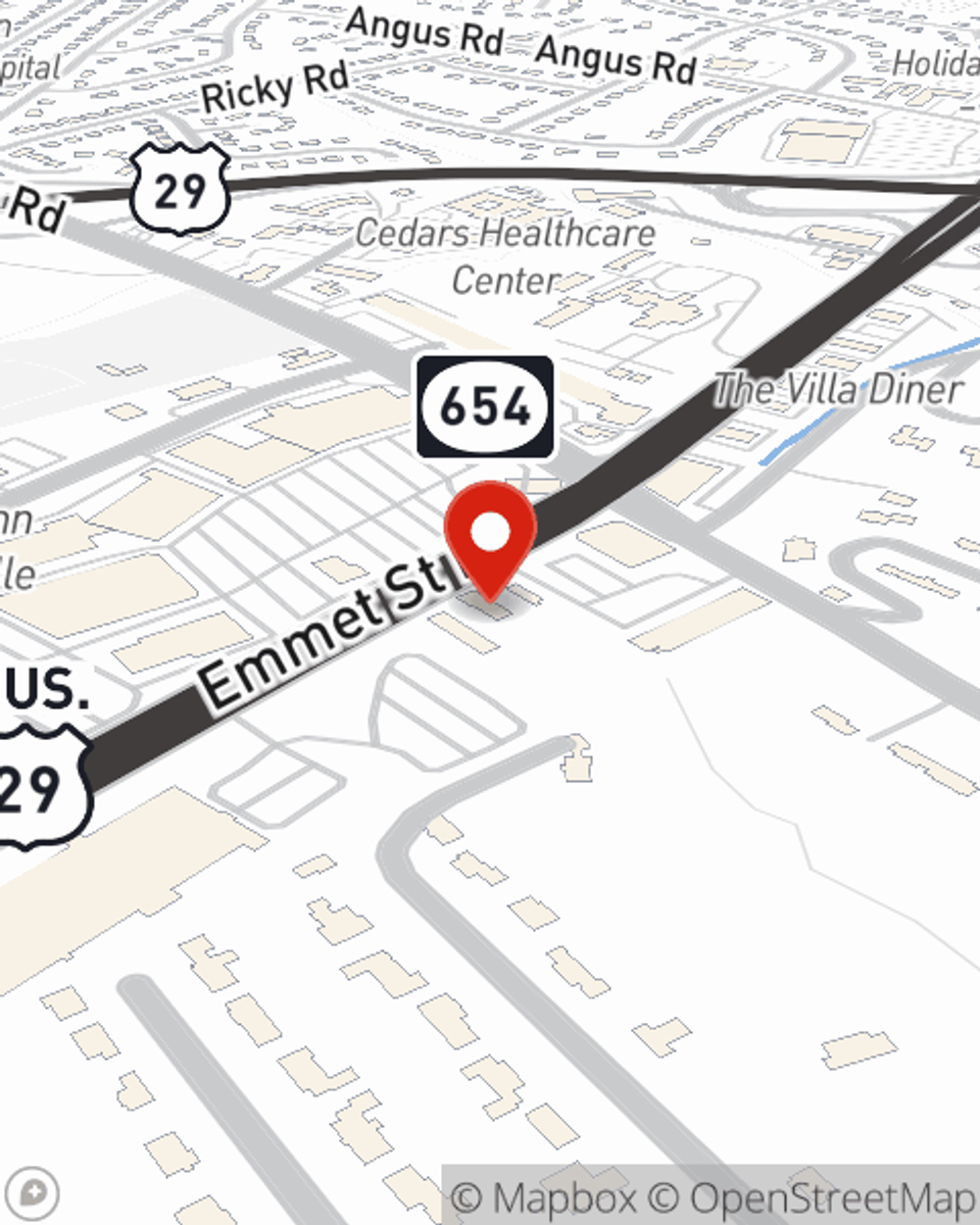

Agent Eva Gee Scott, At Your Service

When renting makes the most sense for you, State Farm can help protect what you do own. State Farm agent Eva Gee Scott can help you with a plan for when the unpredictable, like a water leak or a fire, affects your personal belongings.

As one of the industry leaders for insurance, State Farm can offer you coverage for your renters insurance needs in Charlottesville. Reach out to agent Eva Gee Scott's office to discover a renters insurance policy that can help protect your belongings.

Have More Questions About Renters Insurance?

Call Eva Gee at (434) 977-2741 or visit our FAQ page.

Simple Insights®

How to throw a safe house party

How to throw a safe house party

Learn tips about hosting a safe party at home, respecting your neighbors when you have parties and minding noise pollution laws.

Tips for renting an apartment or a house

Tips for renting an apartment or a house

Here are some things to consider when renting an apartment to help you get ready before you move to your next rental property.

Eva Gee Scott

State Farm® Insurance AgentSimple Insights®

How to throw a safe house party

How to throw a safe house party

Learn tips about hosting a safe party at home, respecting your neighbors when you have parties and minding noise pollution laws.

Tips for renting an apartment or a house

Tips for renting an apartment or a house

Here are some things to consider when renting an apartment to help you get ready before you move to your next rental property.